Security Assessments

Disaster Recovery Planning and Cybersecurity Preparedness

Disaster Recovery for Businesses | Cyber Insurance Assessments

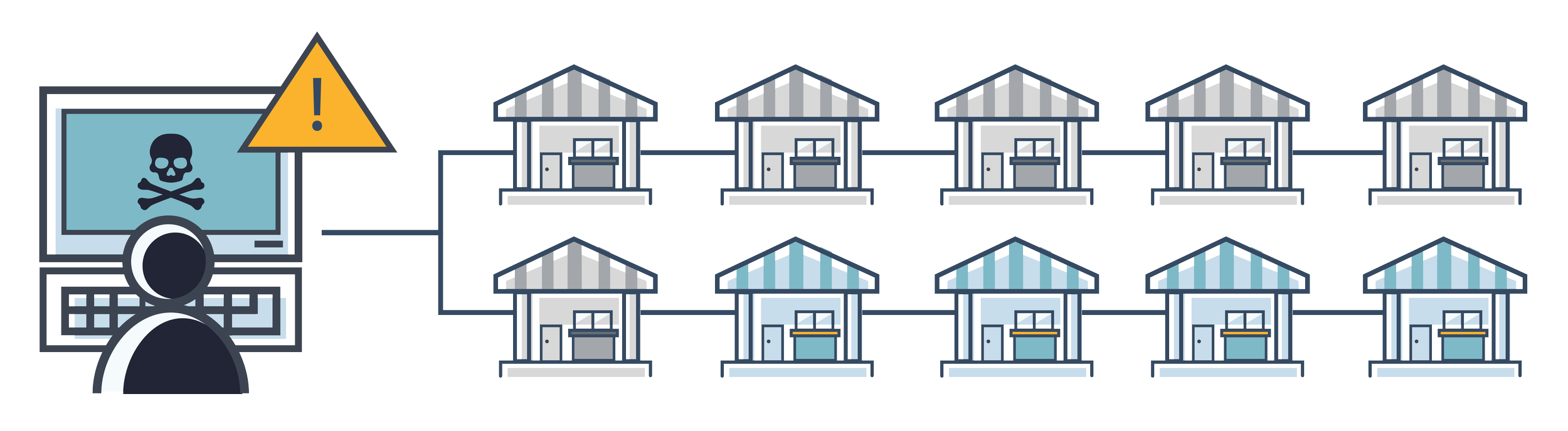

Disaster recovery is an important part of the preparedness process in any organization, and it is especially critical when it comes to technology and cybersecurity. A proper disaster recovery plan should be put in place to ensure that data can be quickly and effectively recovered in case of a disaster or system failure. Additionally, organizations need to have adequate resources and measures in place to ensure that their systems are resistant to cybersecurity threats, including malware and ransomware.

According to the U.S. National Cybersecurity Alliance, 60% of small businesses that suffer a cyber attack go out of business. Large businesses also have long term ramifications. And disasters are not always caused by hackers or cyber invasions. Natural disasters, power outages, burst pipes, and other unexpected events can cause serious damage to your business's technology infrastructure. Without a proper disaster recovery plan in place, these events could lead to data loss or system failure that could put your business at risk of financial losses and reputational damage.

Having a comprehensive disaster recovery plan in place is essential for any organization looking to protect their systems from natural disasters, cybersecurity threats, and other unexpected events. With the right resources and measures in place you can ensure that your data will be safe no matter what happens.

Moser has two tools we can use to help your organization prepare.

According to the U.S. National Cybersecurity Alliance, 60% of small businesses that suffer a cyber attack go out of business within six months. Larger businesses don't fare much better.

Disaster Recovery and Business Continuity Planning Exercises

Being prepared for any emergency is critical for any business. These exercises are an effective way to ensure that your business is ready for anything.

Are you ready if an emergency happens?

If the power goes out in your building and badge readers don’t work, who has keys?

Does everyone know how to respond to ransomware?

What is the first step in your disaster recovery if your servers are lost?

Are you required to adhere to a security framework that requires an assessment?

These exercises are an effective way to ensure that the business is prepared for a disaster. These exercises involve bringing key stakeholders together to discuss and practice responses to common scenarios such as natural disasters, power outages, cyber breaches, or other disruptions in service.

During these exercises, participants will be presented with hypothetical situations based on real-world events. They will then have the opportunity to discuss and practice how they would respond to such a situation.

These exercises are designed to help participants become familiar with their response plans and roles in an emergency. It also allows them to identify any gaps or weaknesses in their plan that can be addressed before an incident occurs.

Overall, the exercises are an essential part of any disaster recovery and business continuity plans. They provide participants with the opportunity to practice their responses in a safe, low-risk environment so that they can be better prepared for real-world disasters.

More than simply having a plan in place, it is also important to ensure that the plan is effective at responding to potential disasters. These exercises help to ensure that businesses are taking all the necessary steps to protect themselves and minimize any disruption when a crisis strikes.

Moser’s business continuity exercises in not an official audit, but it will help uncover problem areas and insure your company is ready when the worst happens to your IT infrastructure. The after action report in an actionable document that explains gaps and suggests options for remediation of shortcomings.

Cyber Insurance Assessments

Cyber insurance assessments ensure you are taking the necessary steps to protect your business from potential data breaches.

Do you have cyber insurance?

Are you following all the rules in your policy to make sure it will be paid out?

Are you following best practices and documenting them?

Are you sure your claim will be paid out if you experience a loss?

Can you lower your insurance costs?

When applying for cyber insurance, the insurance company will assess whether or not you meet their security requirements. This assessment is designed to ensure that you’re taking the necessary steps to protect your business from potential data breaches. To ensure that a business meets these requirements, the insurance company will usually look at a variety of factors, such as the type of technology used, the strength of its cybersecurity infrastructure, and any existing risk management plans.

The assessment will also look at how well the business is able to respond to a data breach or other cyber incident. This includes examining procedures for notifying customers in the event of a breech and having adequate backup systems in place to keep operations running during a crisis.

Overall, the assessment should provide an in-depth look at the business’s security posture and help the insurance company determine its risk level. Once this is determined, they can then decide whether or not to offer coverage for potential incidents and what type of policy best suits their needs. By taking the time to perform a thorough cyber insurance assessment, businesses can ensure that they are adequately protected in case of an attack.

It is essential to note that while cybersecurity assessments are important for getting coverage, they cannot guarantee that you won’t face an incident. It is still possible to suffer a breach even if you take all the necessary steps.

Moser can help navigate these waters with our Cybersecurity Assessment service.